BTC has been a scamcoin in the hands of banks for a long time now.

Since 2017 the Bitcoin name and BTC ticker are owned and controlled by a for-profit company, funded by Banks and "financing" groups with the intent to cripple it and make it harmless. (they succeeded)

It's much easier for them to pretend BTC is Bitcoin, keep it afloat (please look into Tether) and censoring the truth than compete with the real thing.

This is how they do it:

On October 23, 2014, Blockstream goes public and announces funding and the formation of their company.

Shortly after Blockstream was incorporated, they received At least $76 million in venture capital from: AXA ($55 million,

Khosla Ventures, Mosaic Ventures, Horizon Ventures, etc.

AXA Strategic Ventures, iFinex (Tether), Baillie Gifford, PwC, Horizons Ventures, Digital Garage, AME Cloud Ventures, Future\Perfect Ventures, Khosla Ventures, Mosaic Ventures, Seven Seas Venture Partners, Batara Eto

, some of the most powerful venture firms in the world.

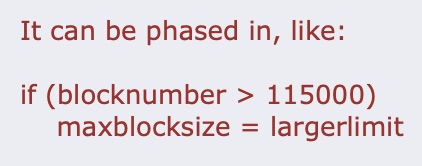

In the Summer of 2015, all of the primary Bitcoin communities such as r/Bitcoin, mailing lists, Bitcoin Talk, wikis, etc., began massive censorship campaigns against any and all topics that had to do with scaling Bitcoin beyond the 1MB limit which, by the way, was temporarily added by Satoshi Nakamoto back in 2010 as a stop-gap measure to prevent spam in the early days.

In the Summer of 2015, all of the primary Bitcoin communities such as r/Bitcoin, mailing lists, Bitcoin Talk, wikis, etc., began massive censorship campaigns against any and all topics that had to do with scaling Bitcoin beyond the 1MB limit which, by the way, was temporarily added by Satoshi Nakamoto back in 2010 as a stop-gap measure to prevent spam in the early days.

This gave them the opportunity to manufacture consent and with the help of bots and astroturfing the Core development team (the only ones having access to the BTC repository) pushed their narrative and crippled Bitcoin.

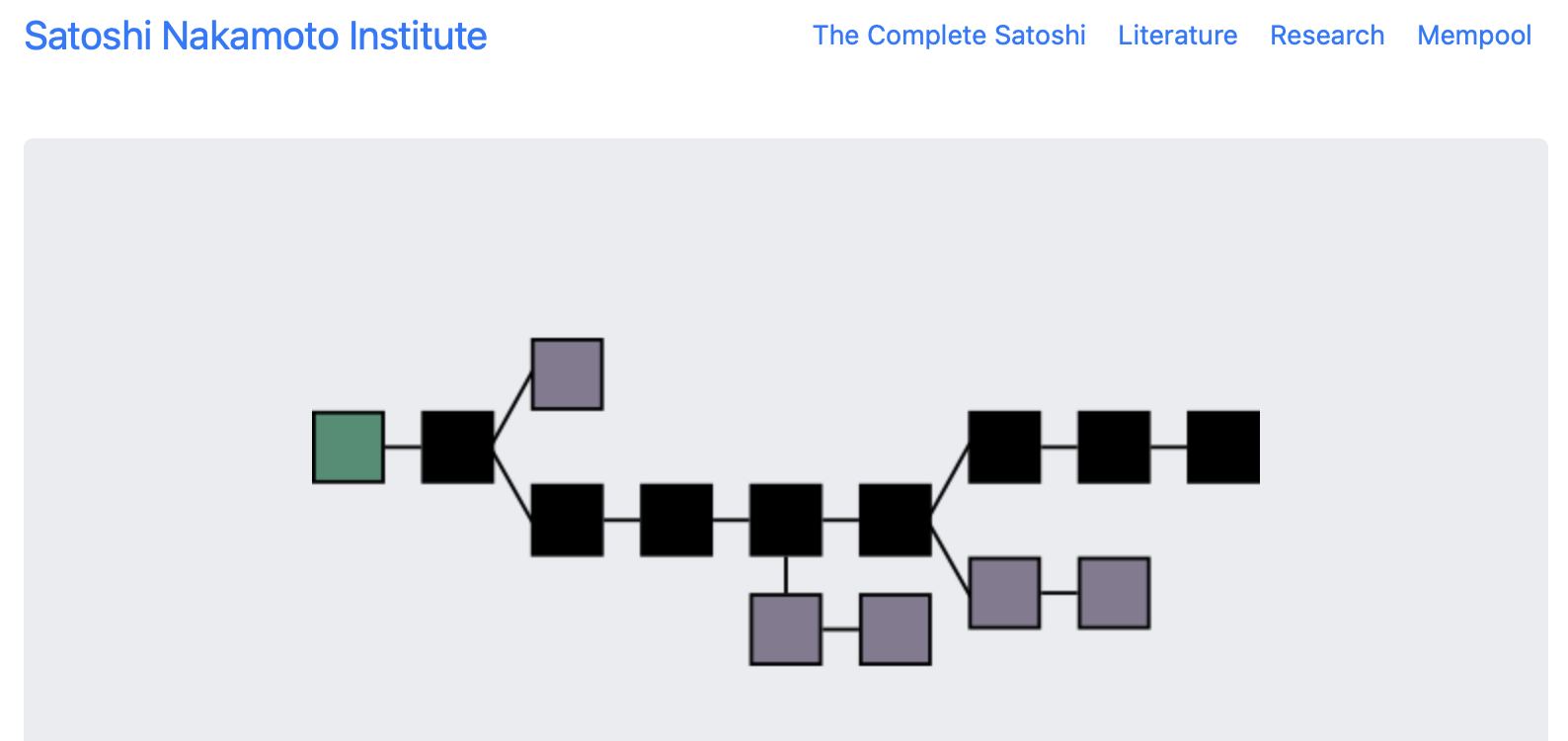

BTC is officially an altcoin; a crude "SegWit" softfork was concocted to poison the Blockchain and change the coin itself to no longer be a “chain of digital signatures,” as per Fig. 1 of the Bitcoin white paper. Making it an unusable (for the public) and harmless (for the banking establishment) altcoin.

In short: The Bitcoin name and repository were hijacked by a for-profit organisation so they could make a buck on their own patented and convoluted "solutions" while rendering it harmless to protect the current financial status quo.

Astroturfing and a tight control over social media to make the public believe BTC is Bitcoin has been proven effective to this day.

Bitcoin just kept on developing Bitcoin.

Luckily, Bitcoin as described in the whitepaper by it's inventor Satoshi Nakamoto continues to exist under the name Bitcoin Cash.

BCH uses Satoshi's codebase from before BTC forked off with SegWit. It also uses the superior scaling solution as described by Satoshi and keeps all transactions Peer-to-Peer on the blockchain. Bitcoin Cash has no single development team or repository that can be hijacked.

Bitcoin has progressed so much in comparison to the old Bitcoin Core (BTC); with speed and features that will never be possible on BTC, it's now more than capable as a truly decentralised cash system to start replacing the existing monetary sham.

People are starting to figure out that Bitcoin Cash is dirt cheap to use (forever) and buy (for now at least, because it's beginning to dawn on the market that BTC is not Bitcoin).

Why cripple and pump BTC?

The government-backed banking establishment is beyond sneaky and sophisticated. They have a million and one tricks to rob you of your money. There are technical tricks, and psychological tricks, and everything in between inside and outside the box.

And they do this because if they weren't that ruthless then someone else would be in charge of the world's money supply.

So don't doubt for a second that they are trying to use all their tricks on Bitcoin. A decentralized permissionless p2p currency will be their death.

Also check out this free tool to print redeemable

Also check out this free tool to print redeemable  In the Summer of 2015, all of the primary Bitcoin communities such as r/

In the Summer of 2015, all of the primary Bitcoin communities such as r/